Your Mint credit

journey

continues

on Credit Karma

Understanding, protecting and improving your credit play an important role in your overall financial health.

And Credit Karma was designed to help you do just that.

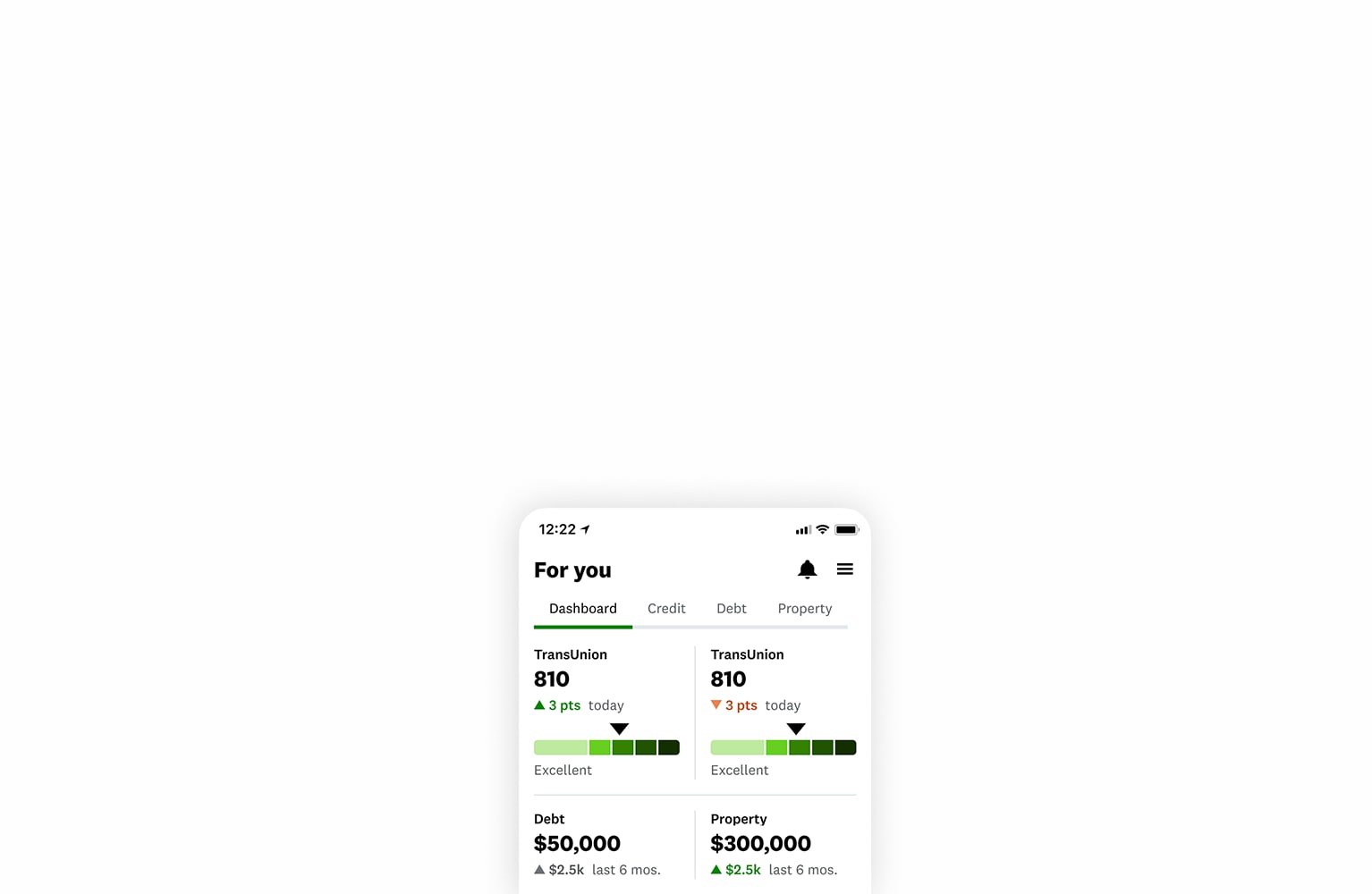

Checking your scores

is 100% free.

The first step in your credit journey is knowing where you stand.

With Credit Karma, you can see your TransUnion and Equifax

reports anytime.

Growth looks good on you.

No matter your starting point, Credit Karma can help you improve your credit over time with personalized recommendations and helpful articles.

Keep track of any changes.

Easily review changes to your credit reports so you can make more informed choices, understand your history and dispute errors when they pop up.

Understand your credit factors.

Gain valuable insight into the different factors that contribute to your overall credit scores and learn ways to improve them

over time.