How Much Do I Need

to Retire?

Written by Mint

Daydreaming about retirement can be easy—you get to do what you want, whenever you want, whether it means traveling across the world or picking up a new hobby. But at the same time, the thought of retirement can be daunting, especially when it comes to figuring out how you’re going to support yourself financially.

Many workers ask themselves, “how much do I need to retire?” There isn’t a clear-cut answer, as the amount of money you need to save for retirement depends on a variety of factors, such as your income and the type of lifestyle you want to live during your golden years. In order to have a substantial nest egg to support you throughout retirement, you’ll want to consider preparing, saving, and investing as early as possible.

To help you get a jump start on retirement planning, we’ve created this guide on how much you need to save for retirement and different ways you can begin planning

for retirement.

In this retirement series, we’ll be providing you with an overview of the essential aspects of retirement planning, like how much you need to save from your paycheck to prepare for retirement, the best ways to start saving for retirement, some 401(k) basics, and other important information.

In this chapter, we’ll be answering important questions like “how much money do I need to retire?” and “how do I save for retirement?” Continue reading to get started.

Calculate How Much You Need

for Retirement

So how much do you need to retire?

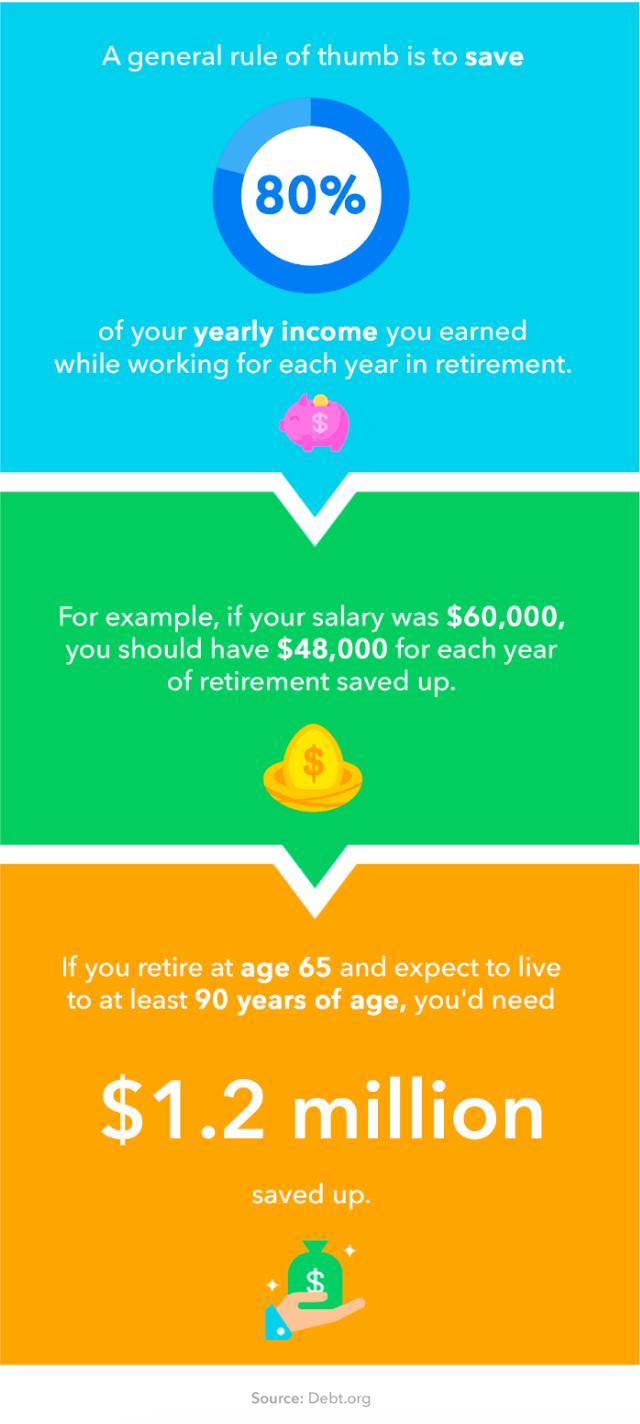

There is no clear cut answer to this question, as determining how much money you need to save for retirement depends largely on your income, how you plan to live during retirement, and what you expect your living expenses to be. So, the amount you need for retirement can vary from person to person. If you plan on traveling extensively or have expensive medical issues, the amount of money you need for retirement might be more than someone with less expensive plans.

According to a 2019 survey by Charles Schwab, it was found that participants believe they need about $1.7 million saved to retire. On top of this, in 2020 the Federal Reserve found that 37 percent of non-retired adults believe their retirement savings are on track, while 44 percent believe they’re not on track, and the rest are unsure. This can make saving up for $1.7 million seem like an unattainable goal.

Don’t let these stats deter you. There are many ways you can take action and get your retirement savings on track. As you begin saving for retirement, take note of how much you should have saved by your age.

While financial experts can’t agree on a set amount of money you should have saved for retirement, these estimates can serve as a guiding reference point.

Whatever formula you use, it’s important to remember that the retirement savings you need by age vary on a case by case basis.

Factors to Consider As

You Prepare

There are numerous factors that can alter how much you’re able to save for retirement throughout your life, such as balancing saving for retirement and your kid’s college, mortgage payments, student loan debt, medical expenses, credit card debt, and so forth. A significant amount of financial planning has to go into figuring out an accurate retirement budget, but we’re here to provide you with some helpful tips for how you can get started.

The key to reaching any sort of retirement goal is to begin saving as early as you can. You can also follow the pay yourself first method, which states that individuals should immediately save a portion of their paycheck before spending it on anything. This mindset can help put more money towards your financial goals, like retirement.

Your savings rate, which is the amount of money you save each month compared to your gross income, is one of the most important percentages to account for when it comes to assessing your retirement savings. And fortunately, there are quite a few ways you can go about saving for retirement.

Take a look at different ways to save for retirement in the section below.

How Do I Save

for Retirement?

So we’ve answered “how much money do you need to retire?”, but what about “how do you save for retirement?” We’ll answer that in the section below.

Whether you’re just entering the job market or are nearing retirement, there are numerous savings vehicles and plans that you can take advantage of to reach your

retirement goal.

Save Early

Compound interest is a powerful thing. The earlier you begin saving money, the more you can have in the future, thanks to compound interest. Compound interest is the process of your principal earning interest and then continuing to earn interest on the interest it has earned in the past. Though this is based on the money staying in an account or being reinvested overtime which means if you pull money or the interest out you reduce the power of

this process.

For example, let’s say you place an initial investment of $10,000 into a high-yield savings account that has an annual percentage yield of 7.00 percent, and it compounded monthly. Without contributing any money after your initial investment, you’ll have about $187,549 in 42 years when you reach 67 years old. Now, let’s say your best friend started with the same initial investment, but ten years later, at the age of 35. By the time they reach 67 years old, they’d only have about $93,323.

As you can see, saving early can earn you more money down the line. Some popular compound interest investments include:

- Stocks

- Bonds

- Treasury securities

- REITs

- High-yield savings accounts

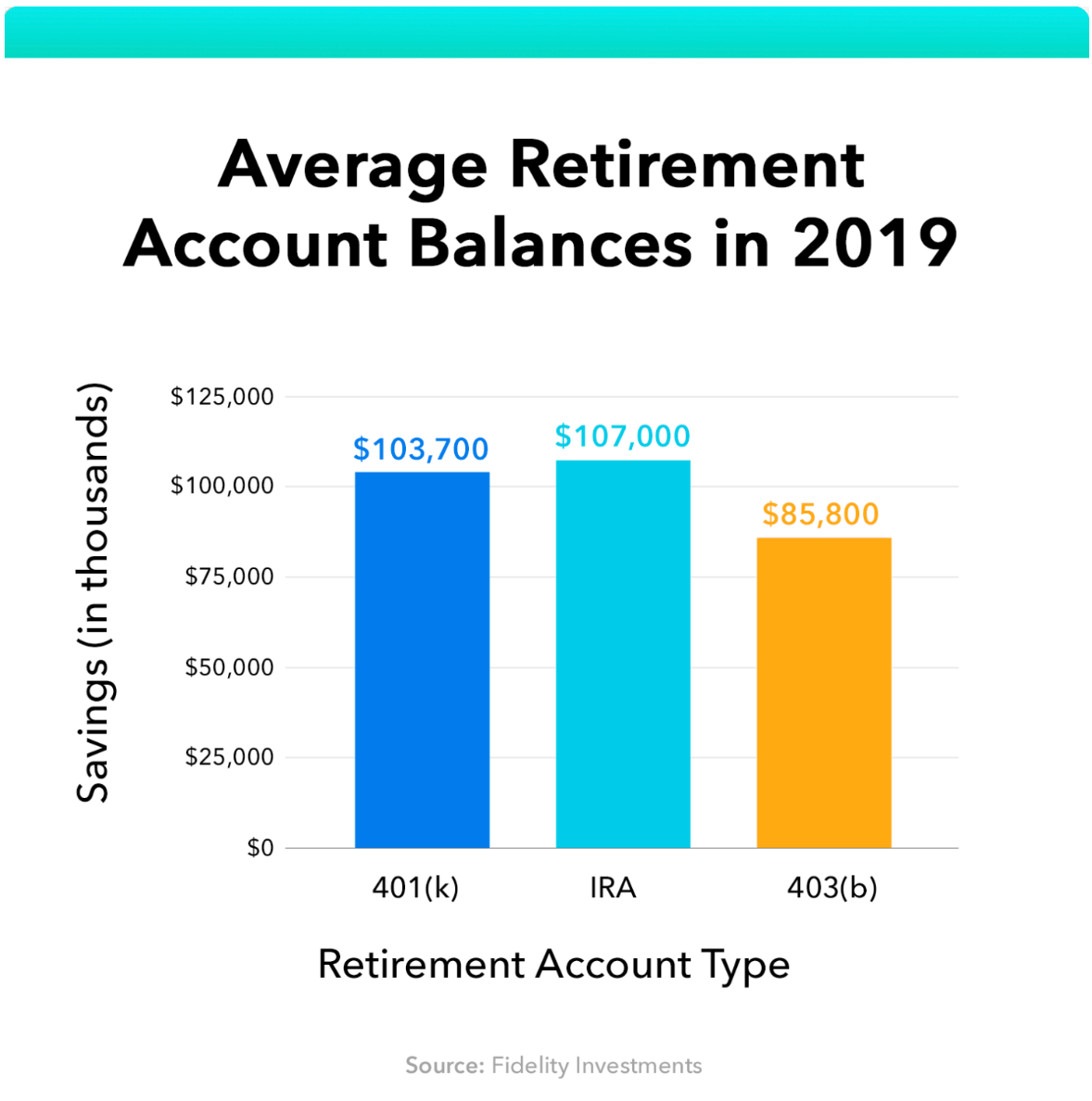

There are several different places you can invest your money, but there are also certain investments that you should consider prioritizing over others, like a 401(k), an IRA, or a health savings account. You’ll earn more interest with these types of accounts and make more money that you can put towards retirement.

401(k)s and IRAs are also examples of tax-deferred savings, which is essentially an investment account that allows you to postpone paying taxes on the money until it’s withdrawn after retirement. Less taxes you have to pay means more money in your pocket.

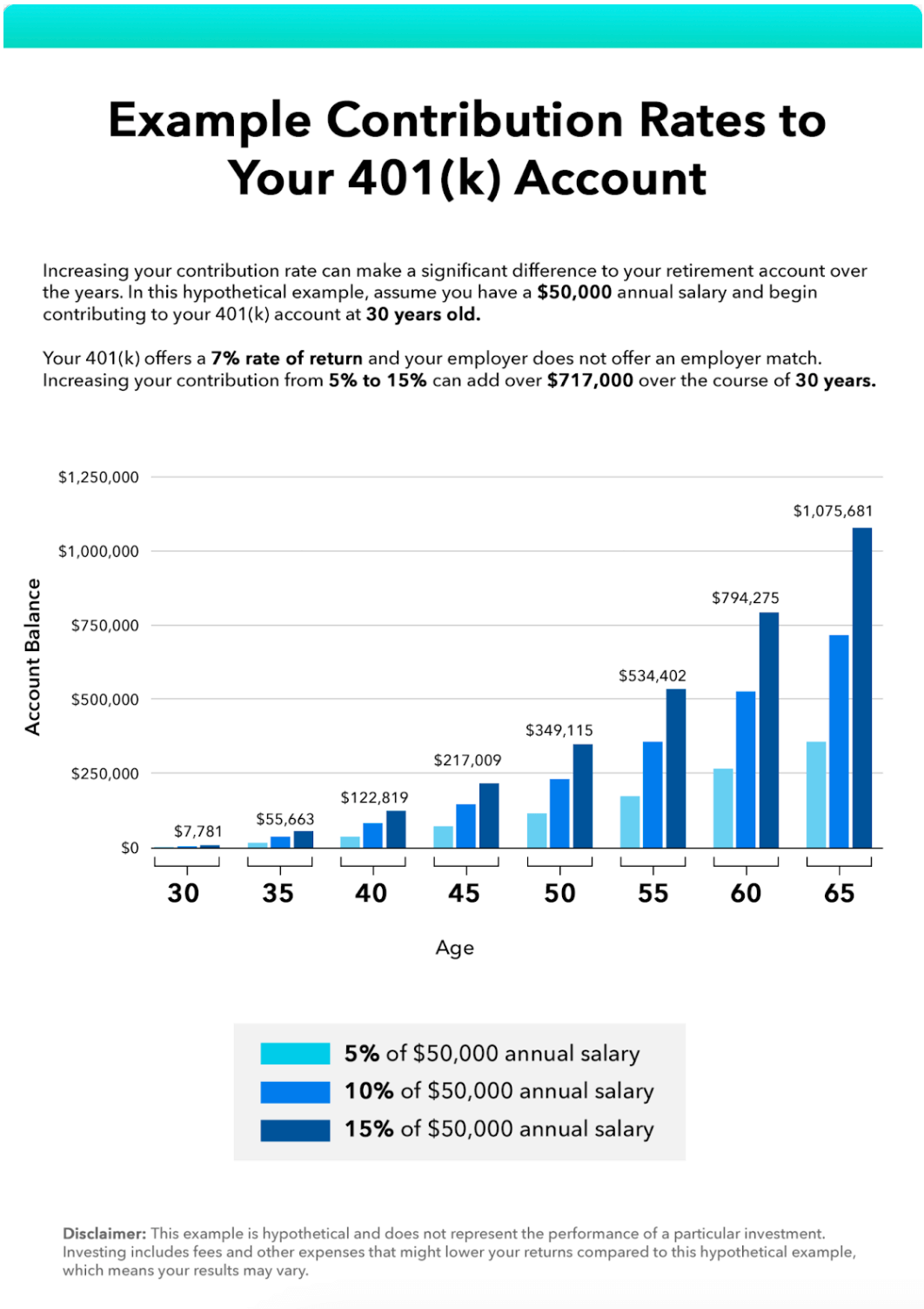

Contribute to Your 401(k) Account

Traditional 401(k) accounts allow you to contribute pre-tax dollars, which lowers your taxable income now. Some employers might even offer an employer match up to a certain percent, which is pretty much like free money. This means if you put aside 5 percent of your income, for example, to your 401(k), and your employer offers a 100 percent match on the first 5 percent, it’ll be as if you’re contributing 10 percent of your income to your 401(k).

However, there are 401(k) contribution limits, which typically increase each year. Contribution limits can also vary by:

- Age

- Retirement plan

- If an individual is considered highly compensated

It’s important to be aware of the average 401(k) balance by age so you can figure out exactly how much you can contribute to your plan.

401(k) retirement plans also compound interest and returns, which means your money will be able to grow faster over time, if all the income is reinvested and kept in the account. If you happen to leave your employer, you have plenty of options when it comes to your 401(k). You can leave it as is, roll your 401(k) into an IRA, or roll it into your new employer’s 401(k) if they offer one. There are pros and cons for each of these options, so do your research before making a decision.

Making an early 401(k) withdrawal might be tempting to do so that you can cover unexpected expenses, but it can do more harm than good. When you make an early 401(k) withdrawal:

- Your taxes are withheld

- You can get penalized by the IRS

- You can lose thousands of dollars in growth

Try to avoid withdrawing from your 401(k) early as it may jeopardize your future financial stability.

Open an IRA

If your employer doesn’t offer a 401(k), or if you want to have multiple retirement accounts to contribute to, an individual retirement account (IRA) can be a smart idea. IRAs provide many tax advantages for retirement savings, similar to 401(k) accounts. There are two popular IRAs you can take advantage of:

Traditional IRAs allow you to make tax-deductible contributions. When you withdraw in retirement, your withdrawals will be taxed as income.

Roth IRAs allow you to contribute after-tax funds and are not tax-deductible. When you make withdrawals in retirement, they’ll be tax-free.

Both types of IRAs can be great options for retirement savings. The one you choose depends on your own preferences and financial situation.

Diversify Your Portfolio

As they say, don’t put all of your eggs in one basket. This saying is relevant when it comes to saving for retirement. Diversifying your portfolio can be a great way to grow your nest egg. Having funds in various securities can reduce risk in the event of a bear market or any market corrections. Some ways you can begin investing and spread your wealth include investing in:

- Stocks

- Bonds

- Mutual funds

- Exchange-traded fund (ETF)

- Commodities

- Real estate investment trusts (REITs)

You don’t need to place your money in dozens of different vehicles. Starting off with just a few can help you keep track of each investment and manage your portfolio easier.

Keep in mind that there are also certain investing mistakes that you want to avoid, like investing too aggressively or too conservatively, and not diversifying your portfolio enough.

Delay Social Security

The Social Security Administration (SSA) was created after the Great Depression left millions of Americans with no savings. This program was specifically designed for those most vulnerable: the elderly, disabled individuals, and their survivors. Today, Social Security serves the same purpose and provides Social Security benefits to:

- Retired workers

- Disabled workers

- Their survivors, such as dependent children and spouses

Eligible retirees are able to withdraw Social Security payments as early as 62 years-old. There’s a catch, though. If you withdraw payments before your full retirement age (FRA), your benefits will be reduced a fraction of a percent for each month for the entirety of the payments.

Delaying Social Security, on the other hand, has reverse effects. If you delay your Social Security benefits, you can increase the amount of the benefits you receive in

the future.

For example, if your full retirement age is 66 years-old, your 12-month rate of increase is 8 percent. That means, once you reach 67 years-old, you’ll receive 108 percent of your monthly benefit. This increase stops once you reach the age of 70, meaning you’ll receive 132 percent of your monthly benefit by the time you reach this age. As you can see, delaying Social Security for even a few years can make a huge difference in the long run.

Social Security can be a great form of supplemental income during retirement. However, Social Security benefits typically only cover about 40 percent of your pre-retirement income, which is why planning and saving early should be taken seriously. Additionally, Social Security is not guaranteed. Currently, the Social Security Board of Trustees projects program costs to rise by 2035; at that point, taxes will be enough to pay for only 75 percent of scheduled benefits. So current benefit estimates are likely over estimated.

Reduce Spending

Budgeting is another important factor when it comes to planning for retirement. Creating a plan to reduce spending can help you place more money into different retirement vehicles, such as an IRA or savings account.

When it comes to cutting spending, consider expenses you may no longer need, such as:

- Streaming service subscriptions

- Going out to dinner

- Expensive gym memberships

Take Advantage of Catch-up Contributions

There are limits to how much you can contribute to your 401(k) and IRA plans. However, when you reach the age of 50, you’re entitled to catch-up contributions.

If you haven’t been able to contribute as much as you’d like over the years, catch-up contributions can help you get back on track.

The Four Percent Rule

So, what should you do with your money once you reach retirement? Withdrawing all your hard-earned savings and going on an extravagant trip may sound like a good idea, but finance experts have other advice: the four percent rule.

The four percent rule came from a 1998 study called the Trinity Study and is fairly simple. It says, during retirement, retirees should only withdraw 4 percent from their retirement portfolios to not run out of money over a 30-year period. So, you should withdraw $4,000 for every $100,000 you have saved. The four percent rule can be a great way to live comfortably during retirement without compromising all of your savings.

Although this is stated as a rule, it’s best to look at it as a guideline. Every retiree is different, with their own:

- Tax bracket

- Sources of income

- Investments

- Financial plan

And all of these should be considered when making financial decisions, whether it be using a credit card or investing in multiple securities to fund their golden years. Take this with a grain of salt, and consider consulting with a financial advisor when it comes to making financial decisions during retirement.

Final Considerations When Deciding How Much to Save

There are a few key considerations you should keep in mind when finalizing your retirement plan, such as:

- Where you want to live: The place you want to live will heavily impact how much your savings need to be. Retiring in Ohio is going to be a lot cheaper than retiring in California. But you don’t have to retire somewhere that’s going to completely wipe out your savings, in fact there are many affordable places to retire, where you can live lavishly while saving money.

- What kind of lifestyle you want to lead: Do you want to go on extravagant trips every month and splurge on designer goods? Or do you envision spending your golden years relaxing at home with your spouse? The type of lifestyle you plan to lead heavily impacts your savings goals.

- Whether you plan to own a home or rent: Owning a home offers more stability, tax benefits, and equity, but renting a home provides more flexibility and equity, and you’ll probably end up spending less money on maintenance.

- Whether you want to downsize: Downsizing your home during retirement can have some advantages, but it’s not for everyone. Since housing can be a major expense, it’s definitely something you want to consider when planning for retirement.

Key Takeaways: How Much Do I Need to Retire?

- Determining how much money you need to save for retirement depends largely on your income and how you plan to live during retirement.

- According to a recent survey by Charles Schwab, it was found that participants believe they need about $1.7 million saved to retire.

- The key to reaching any sort of retirement goal is to begin saving as early as you can.

- There are numerous savings vehicles and plans that you can take advantage of to reach your retirement goal, like:

- Saving early

- Contributing to your 401(k) plan

- Opening an IRA

- Delaying your Social Security

- Reducing spending

- Finance experts recommend following the four percent rule once you enter into retirement, which is that retirees should only withdraw 4 percent from their retirement portfolios to not run out of money over a 30-year period.

Wrapping Up

How much you need for retirement depends on a variety of factors. Some retirees may have additional sources of income, such as from part-time jobs, Social Security, and pensions that determine their amount needed to retire. Or, some may decide to retire early or have plans for an extravagant lifestyle during their post-career years.

Whatever your situation is, it’s important to begin planning early to live comfortably in retirement. There are numerous retirement vehicles available, such as IRAs, 401(k) plans, investments, and more.

Now that you have the wheels turning about how much money it takes to retire comfortably, you can move on to the next chapter in the series, which covers how much to save each month for retirement.

This is for informational purposes only and should not be construed as legal, investment, credit repair, debt management, or tax advice. You should seek the assistance of a professional for tax and investment advice.

Sources: Charles Schwab | Federal Reserve | Debt.org | SSA.gov 1, 2, 3 | IRS.gov | RBC Wealth Management